In the vast and often intimidating world of investing, there’s a quiet revolution that’s making wealth-building more accessible than ever before. This is the realm of micro-investing, a strategy that turns the conventional wisdom of needing large sums of money to invest on its head. Here, we delve into five micro-investing strategies that can help you grow your wealth, even if you’re starting with just a few dollars.

The Power of Spare Change

Imagine if every time you bought a coffee or filled up your gas tank, you were also investing in your future. This is exactly what spare change apps do. These innovative tools round up your purchases to the nearest dollar and invest the difference. It might seem like a trivial amount, but over time, these small contributions can add up significantly.

For instance, if you spend $3.50 on a coffee, the app will round it up to $4 and invest the 50 cents. While 50 cents might not seem like much, if you do this for every purchase, it can quickly accumulate. Moreover, these apps often come with automated features that make investing a seamless part of your daily routine, requiring minimal effort from your end.

The Consistency of Automatic Transfers

One of the most effective ways to build wealth is through consistency. Setting up automatic transfers from your paycheck to your investment account ensures that you invest a fixed amount regularly, without having to think about it. Even $10 or $20 a month can make a substantial difference when invested consistently over years.

This approach leverages the power of compounding, where your investments grow not just from the principal amount but also from the interest earned on that principal. It’s a slow but steady process that can lead to significant wealth accumulation over time. The key here is to make investing a habit, much like paying your bills or saving for retirement.

The Accessibility of Fractional Shares

Traditional investing often requires a substantial amount of money to get started, especially if you’re interested in high-value stocks. However, with the advent of fractional shares, this barrier has been significantly lowered. Many brokers now offer the option to buy partial shares of expensive stocks, allowing you to invest in companies like Apple or Amazon without needing thousands of dollars.

For example, if you want to invest in a stock that costs $100 per share but you only have $50, you can buy half a share. This flexibility makes high-value stocks accessible to everyone, regardless of their financial status. It’s a game-changer for those who want to diversify their portfolio without breaking the bank.

The Efficiency of Robo-Advisors

Robo-advisors have revolutionized the investment landscape by offering low-cost, automated investing solutions. These platforms typically have low or no minimum investment requirements, making them ideal for micro-investing. They use algorithms to diversify your portfolio, spreading your investments across various asset classes to minimize risk.

One of the standout features of robo-advisors is their hands-off approach. Once you set up your account and define your investment goals and risk tolerance, the platform takes care of the rest. This is particularly beneficial for busy individuals or those who are new to investing and prefer not to manage their investments actively.

The Magic of Reinvested Dividends

When you invest in stocks or mutual funds, you often receive dividends – portions of the company’s profit distributed to shareholders. While it’s tempting to cash out these dividends, reinvesting them can significantly accelerate your wealth growth.

Reinvesting dividends leverages the power of compound interest, where your returns earn returns. Over time, this can lead to exponential growth in your investments. For instance, if you invest $1,000 and earn a 5% dividend, you’ll receive $50. If you reinvest this $50, next year you’ll earn dividends not just on the original $1,000 but also on the $50 you reinvested. This snowball effect can turn small investments into substantial wealth over the long term.

Building Wealth Gradually

Micro-investing is not about getting rich quick; it’s about building wealth gradually through consistent, small investments. It’s a strategy that encourages patience and persistence, rather than quick gains. By integrating micro-investing into your daily financial routine, you’re not just investing money; you’re building a habit that can serve you well over the years.

This approach also helps in reducing the psychological barrier to investing. When you start with small amounts, the risk feels less daunting, and the process becomes more manageable. As you see your investments grow, you’ll become more confident and likely to increase your contributions over time.

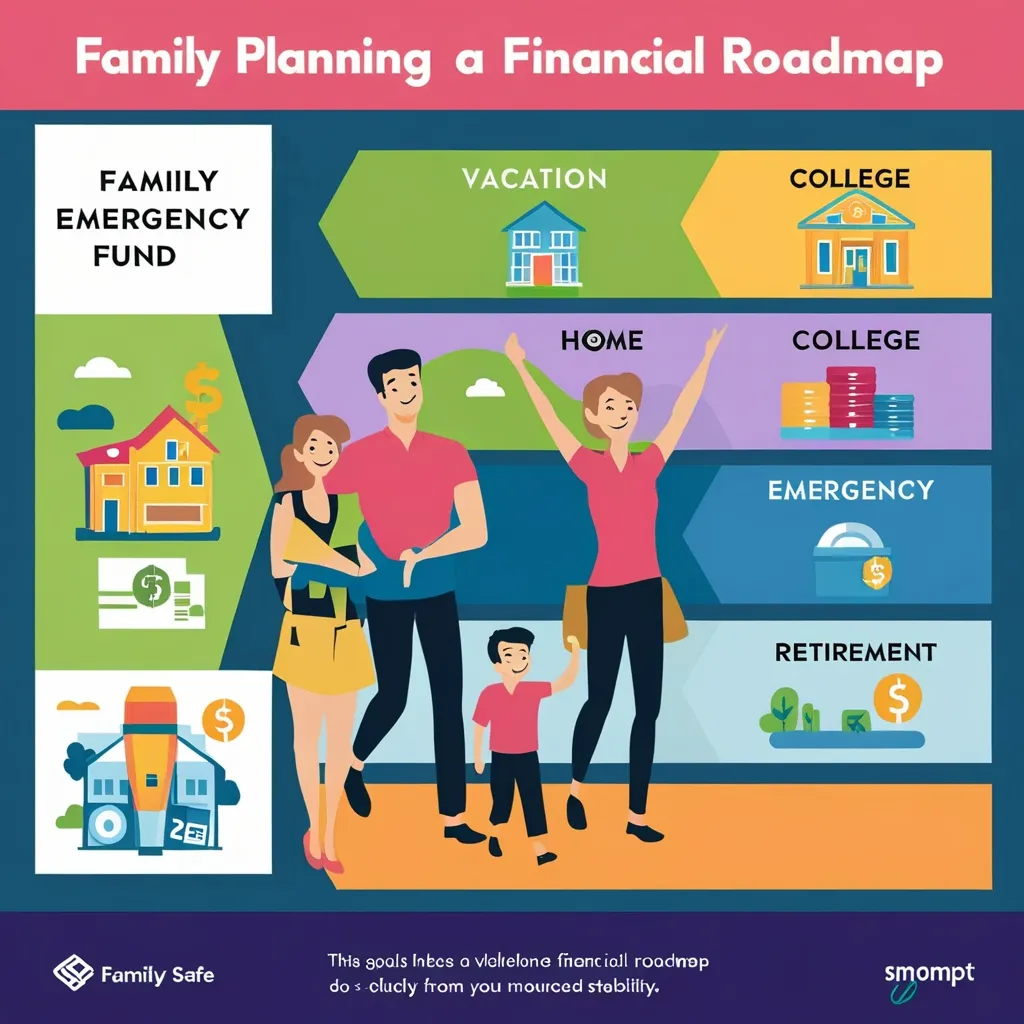

Financial Goals and Flexibility

Micro-investing is versatile and can be tailored to meet various financial goals. Whether you’re saving for an emergency fund, a vacation, a down payment on a house, or retirement, micro-investing provides a flexible way to grow your money over time.

For short-term goals, you might opt for a low-risk portfolio to accumulate funds with less exposure to market volatility. For long-term goals like retirement, a more aggressive portfolio with higher risk but potentially higher returns might be more appropriate. The flexibility of micro-investing allows you to adjust your strategy as your financial goals evolve.

The Role of Financial Advisors

While micro-investing platforms are designed to be user-friendly and accessible, the role of a financial advisor can be invaluable. They can help you understand your financial goals, risk tolerance, and investment preferences, making the process even more personalized.

Financial advisors can demystify the often-complex world of investing, providing you with a clear understanding of where your money is going and how it’s working for you. This personalized service empowers you to make informed decisions and pursue your financial objectives with confidence.

Conclusion

Micro-investing is more than just a strategy; it’s a mindset. It’s about recognizing that every dollar counts and that small, consistent investments can lead to significant wealth over time. By leveraging spare change apps, automatic transfers, fractional shares, robo-advisors, and reinvested dividends, you can build a robust financial foundation without needing a large initial investment.

In a world where financial independence is a key goal for many, micro-investing offers a practical and accessible way to start your investment journey. It’s a reminder that wealth-building is not just for the wealthy; it’s for anyone willing to start small and be consistent. So, whether you’re a student, a young professional, or someone looking to supplement your traditional investments, micro-investing is a powerful tool that can help you achieve your financial goals, one small step at a time.